A Memorandum of Understanding (MoU) between Bank Islam Malaysia Berhad (Bank Islam) and Persatuan Syarikat Pengendalian Pelancongan Bumiputera Malaysia (BUMITRA) was signed to provide financial solutions for potential hajj pilgrims planning to subscribe to hajj packages through 22 Pengelola Jemaah Haji (PJH) companies appointed by Lembaga Tabung Haji (TH), which are also members of BUMITRA.

The MoU also aims to affect a partnership and knowledge-sharing session educating BUMITRA members on financing solutions Bank Islam provides, especially for Hajj and Umrah. The collaboration area includes disseminating information regarding the facilities and services offered.

Among the services include Debit Card-i Bank Islam Visa Tabung Haji. The debit card has various unique features and exclusive rewards for cardholders. Besides offering a vast payment network and cash access worldwide, the card facilitates financial transactions for hajj pilgrims in Arab Saudi, including waiving the charges for cash withdrawals during hajj season.

At the event, Bank Islam also launched a campaign, ‘Once in a Lifetime’, especially for potential Hajj or next of kin who want to help parents to perform Hajj by applying for this personal financing with a minimum amount of RM50,000. The campaign runs from 24 March to 31 May 2023 and offers a chance to win Umrah package prizes.

The personal financing package provides an opportunity for prospective Hajj pilgrims who can repay the financing in a structured manner according to their respective financial capabilities.

Mohd Muazzam said, “Since the cost of the Hajj package is increasing due to external factors, the personal financing offered is timely to enable more Muslims who can fulfil the 5th pillar of Islam.”

“Meanwhile, Bank Islam’s role is not only limited to a financial solution hub for pilgrims but will be expanded comprehensively to more than 600 tourism companies registered under BUMITRA and their customers,” Mohd Muazzam adds.

Apart from Personal Financing products and Bank Islam Tabung Haji Visa Debit Card-i, Bank Islam, as a hub of financial solutions for pilgrims, also offers other products such as the Al-Awfar investment account, credit card-i, takaful protection products, will-writing, online and mobile banking facilities and foreign currency exchange at Bank Islam’s ‘Bureau de Change’ counter. With the existence of these benefits, it is in line with Bank Islam’s aspiration, which is ‘Urusan Dipermudah, Lebih Tenang Beribadah’.

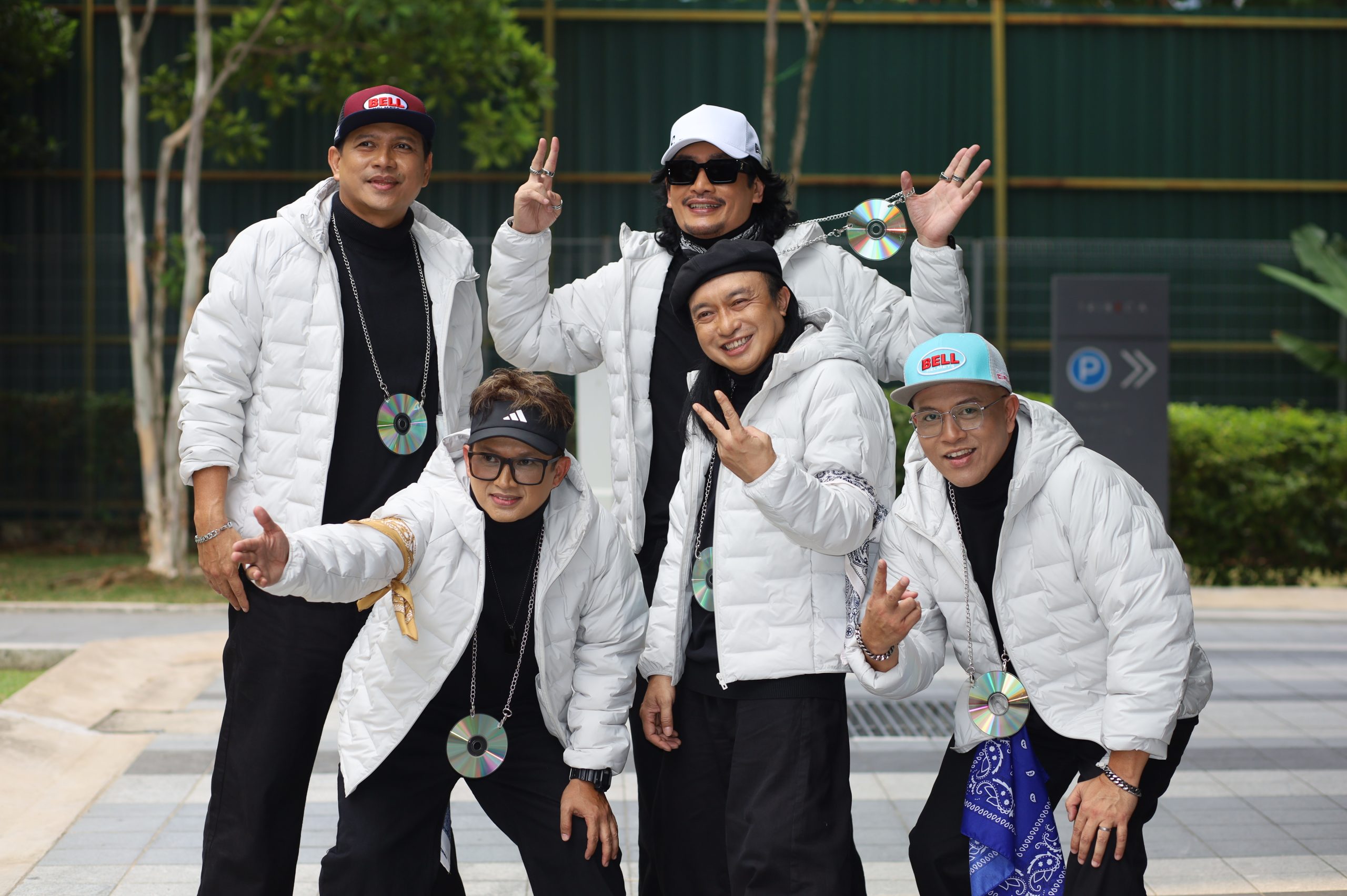

The MoU was signed by Mizan Masram, Group Chief Business Officer – Retail, Bank Islam Group and BUMITRA and AB Rahman Mohd Ali, BUMITRA’s Honorary Secretary General. Mohd Muazzam Mohamed, Bank Islam Group Chief Executive Officer; Harun KC Ahmmu, President of BUMITRA and Mohamed Ameen S.M.A Abdul Wahab, Executive Director Operations, TH Group Operations Division, witnessed the signing.

Customers who want more product information can visit the nearest Bank Islam branch.